Content

A parking lot will only last a few years before it will need to be resurfaced or repainted. Land improvements can also include landscaping, sprinkling What are Land Improvements? systems, lighting systems, and much more. When a company buys a building, the building is usually depreciated of its useful life.

Like all land improvements, a parking lot has a limited life. Within the PP&E section, items are customarily listed according to expected life. Land is listed first, followed by buildings, then equipment. For some businesses, the amount of Property, Plant, & Equipment can be substantial. This is the case for firms that have large investments in manufacturing operations or significant real estate holdings. Other service or intellectual-based businesses may actually have very little to show within this balance sheet category. Deforestation is also the reason for loss of a natural habitat, with large numbers of trees being cut down for residential and commercial use.

Real Estate Transactions

The cost approach is generally the more conservative of the two methods, but market values are more useful for comparing the farm’s financial condition with that of other farms. Indicates the efficiency by which a company uses its property and equipment to generate sales revenues. If a company has large amounts reported for various fixed assets but fails to create high revenue balances, the ability of management to make good use of those assets has to be questioned.

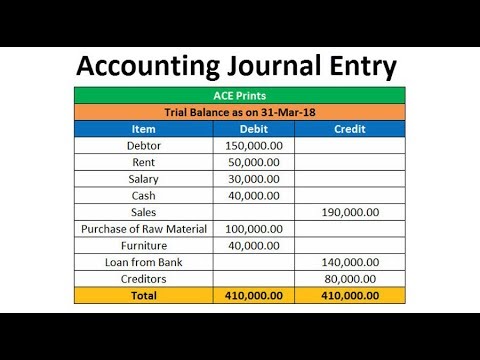

One category includes expenditures related to land upon its acquisition; these are expenditures to prepare land for its intended use. The other category includes improvements to land subsequent to its acquisition. The journal entry is debiting depreciation expense $ 4,000 and credit accumulated depreciation $ 4,000. The transaction will increase the the land on balance sheet $ 30,000. It also reduces the cash balance of $ 30,000 if the company has already made a payment to the seller.

Land Improvements Journal Entry

Improvements means the buildings, structures, improvements, and alterations now constructed or at any time in the future constructed or placed upon the Land, including any future replacements and additions. The term “Non-leased Premises” shall mean the Entire Premises less the Leased Premises. ; no matter which way one accounts for the cost, it is not apt to bear on anyone’s decision-making process about the company. This again highlights the degree to which professional judgment comes into play in the accounting process. Professional judgment was required to estimate the value of the components for purposes of making the preceding entry.

New casino, tribal land improvements coming to Tucson’s west side – KOLD

New casino, tribal land improvements coming to Tucson’s west side.

Posted: Tue, 03 Jan 2023 08:00:00 GMT [source]

The cost of a parking lot or sidewalk, for example, is capitalized and then written off to expense in the same manner as the accounting for buildings and equipment. There are several reasons why companies don’t charge assets in a single period. Most importantly, it is because the matching principle of accounting requires companies to charge expenses in the period that they help generate revenues. Companies use depreciation to contribute to the value of fixed assets over a period of time.

SPA Process User’s Guide –

The Small Business Agency estimates that about 30 percent of small enterprise failures arise out of cash flow problems. However, with proper accounting practices, it is easy to avoid this pitfall. While it is easy to know your main numbers like sales figures and expenses, getting into details like taxes and depreciation can be more challenging. Buildings are treated as a separate type of capital from land improvements.

Is a retaining wall a land improvement?

Examples of land improvements include, but are not limited to, site improvements such as landscaping that has a limited life (e.g. shrubbery, flowers, trees); retaining walls, parking lots, fencing, sidewalks, sculptures, and art work.

The cost of property, plant, and equipment includes the purchase price of the asset and all expenditures necessary to prepare the asset for its intended https://online-accounting.net/ use. Note that land is recorded on the balance sheet in a separate account called Land. Land is a separate asset within Property, Plant, and Equipment.

Land does not have a defined useful life, making it nearly impossible to account for depreciation. Its value may either rise or fall over time, depending on different factors. For instance, a real estate boom can push up land prices, while an environmental catastrophe can decrease values. The assets on land, like buildings, qualify for depreciation. Either way, the value you receive will be much less than your purchase price.

- The entire project costs would be capitalized under buildings.

- Site Improvements means any construction work on, or improvement to, streets, roads, parking facilities, sidewalks, drainage structures and utilities.

- Initially, they spread rapidly throughout many of the irrigated zones of the developing world where rice and wheat cultivation was concentrated and where population densities were high.

- R.J. Oosterbaan, International Institute for Land Reclamation and Improvement, Wageningen, The Netherlands.